Rise Benefits

RiseMed Health

Because Your Business Is

Worth It!

We Turn Complex to Simple and Easy To Understand.

So Your Business Keeps Going. And Going. And Going…

Customized Plan Design and Consultation

Cost Containment and Tax Savings Strategies

Unparalleled Support & Fiduciary

An Agency You Can Trust!

Rise Benefits offers a full spectrum of benefits planning & protection for SMB business! Our services are difficult to duplicate! Other agencies simply cannot provide the same value to our clients no matter how hard they try! Our background in healthcare, human resources and leveraged strategies on business planning can provide our clients with endless possibilities!

Customized Blueprint for Your Business

Competitive Rates

Unmatched Support

Procedures & Systems in Place

Quality Financial Products & Insurance Services

Synergy & Expertise

Constant Innovation

Advanced Planning

What we offer

Voluntary & Group Benefits

Attract, retain, and develop your talented people with Voluntary and Group Benefit packages.

We offer generic packages like family coverage health care, vision, and dental plans.

Innovative packages like savings plan, index funds, etc.

Business Protection

Protect your gains! Are you secured from changes in economic dynamics? from calamities related to climate change?

We can guide you with Business Protection Insurance and how to secure your hard earned efforts.

Business Solutions and Capital

Bridge Capital, Commercial Real Estate, Hard Money, Bank Financing… and more!

We source the business financing you need without having you go through the hoops.

Retirement Services

Prepare for a sustainable retirement with predictable month-to-month income and achieve your retirement goals! Travels, golf, sail boat, grand kids, or simple living lifestyle – we can make this goal happen for you.

Grow Your Business, Attract & Retain Your Valued Employees!

The Difference Between a “Status Quo” Insurance Broker and a RiseMed Benefits Advisor…

Delivering healthcare to your employees is a growing business challenge. Not only do annual premiums rise year after year, but more employees are making career decisions based on benefits plans, especially as pressure on consumer healthcare costs increase as well.

And that’s where we come in! You can team up with Rise Benefits today even if this is not your normal open enrollment month. Our job is to save you money and improve your employee benefits & costs. Plus, your employees will thank you!

Engineers , Contractors & Architects

Risk Management for Engineers and Architects in the Construction Industry

What Our Customers Say…

Our company utilized Rise Benefits Advisor services for our voluntary and group benefits. They had dealt with our problems and concerns in a really professional and timely way. Our employees are satisfied and happy by using their proposed health benefits, personal voluntary benefits, income and protection plans. They also added some financial & wellness plans and mental health pogram that are really important for our employees. They also saved us some money for our healthcare costs. Thank you Rise Benefits.!

Dr. R. Torres/Dra. MS TorresShirley Sime has proposed us a business protection insurance plan and we liked what she did because their plans really matched our business needs and other recommendations were helpful and insightful related to our future growth. Shirley, with her team, is really helpful and very nice, she is always available for support 24/7 on one on one calls and she also stays in touch with us on a regular basis.. Thank you Rise Benefits!

Patick Shakal/Irene ShakalYour care & compassion to our business and our employees is really commendable. We as a company love the services and pricing you offer. Appreciated! We have referred you to our clientele as well!

Lindy FreyWe have been with Shirley and her agency for a few years and to date, Shirley and her wonderful team have always helped us with financing and insurance for our commercial real estate projects . We are Very happy connecting with Shirley. More Power!

Art Lapid/Dr.Louie AnquiloOur Partners

We collaborate with top-rated, reputable insurance, financial services and healthcare organizations.

And More! Everything You Need for Your Next Employee Benefits Program!

Dear Business Owner,

With the current state of healthcare in the US today, foremost in every employee’s mind would be questions how they would cope with healthcare costs for himself and family. Questions abound if there are healthcare benefits provided and how much if any would be their share in that responsibility.

As a common consensus, business’ objective is to attract and retain talent and compete most effectively. As the business owner, you need to strike a balance between the cost of providing benefits and the economics of running the business. Voluntary Benefits would typically include health insurance, some life and disability insurance and probably a retirement savings plan too. You need to craft a well-balanced basket of benefits that is neither too lavish nor too austere.

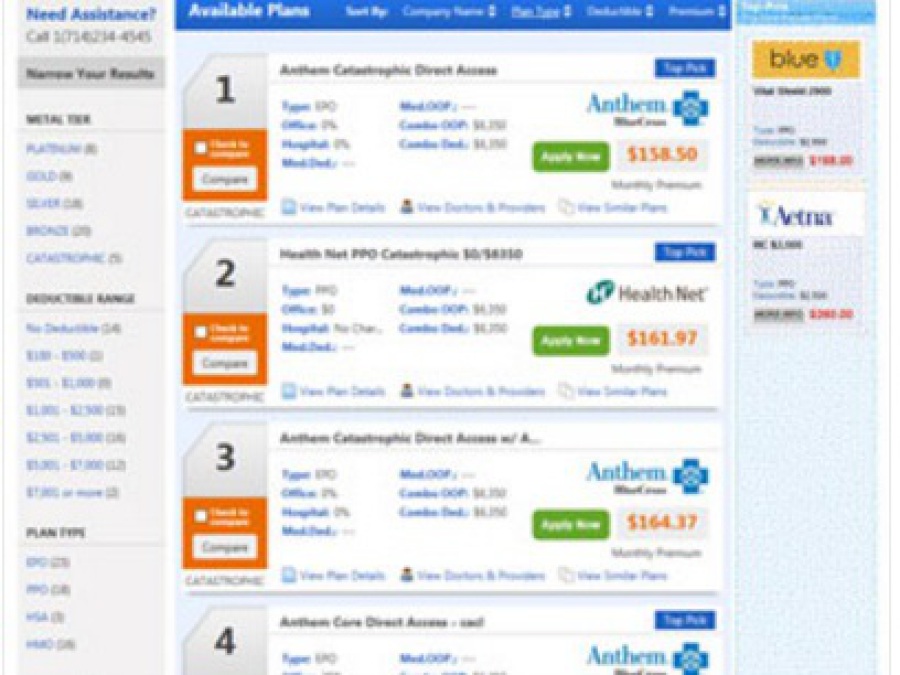

With a myriad of plans out there from multiple providers — things can get confusing and costly — and you end up doing nothing. Look for advice that would simplify things for you at your stage of the business at the least cost.

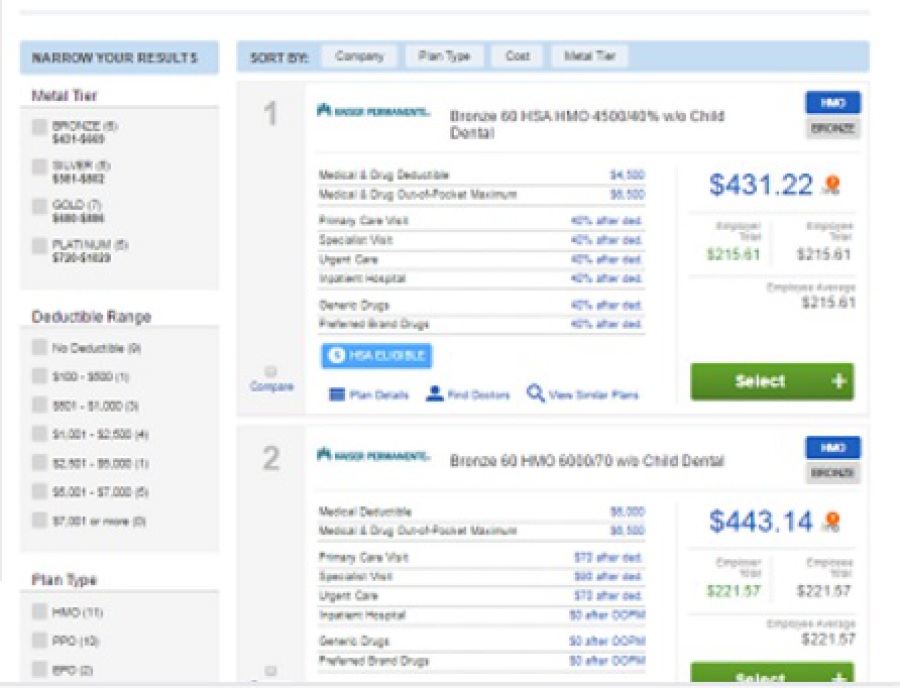

Maximize use of Online Quotes to compare plans and check out prices. It’s convenient to use when comparing multiple quotes from various insurance carriers.

Start the selection process by simplifying the benefits into three main areas: health care, retirement savings plan and specialty benefits. You need not have all of them at the same time or all benefits to all employees. While there is no one-size-fits all solution, there are guidelines for choosing the right benefits package.

The first stop: talk to a Plan Advisor (or broker) the likes of RISE Insurance Capital Network. Check them out here. You’ll be glad you did!

Dr. Collins

Family Health Care

- $0 deductibles, $0 copay, no co-insurance

- Set dollars for doctor visits, hospitalization, and lab works

- And more!

Compare quotes from hundreds of carrier plans including:

- Disability

- Short and Long term disabilities

- Critical illness

- Income replacement and more!

Contact us

Stay updated with benefits & compliance news!

Join the list!

Zero spam. Unsubscribe at any time.

RISE Insurance Capital Network, LLC

400 Mill Street Suite 203 Reno, NV 89502

Broker-Agency License #327-6911

Phone Number: 775-344-9955